The following table sets forth certain information with respect to restricted stock unit vesting during the fiscal year ended December 31, 2021,2023, with respect to the Named Executive Officers. No Named Executive Officers exercised any stock options during 2021.2023.

The following table sets forth the estimated value of the potential payments to each of the Named Executive Officers, assuming the executive’s employment had terminated on December 31, 2021,2023, under the scenarios outlined below.

For the events of termination involving a change in control, we assumed that the change in control also occurred on December 31, 2021.2023. In addition to the payments set forth in the following tables, the Named Executive Officers may receive certain payments upon their termination or a change in control pursuant to our Flowserve Corporation Deferred Compensation Plan, Qualified Pension Plan, SERP and SMRP. Previously vested amounts and contributions made to such plans by each Named Executive Officer are disclosed in the “2021“2023 Pension Benefits” table.

Our CEO to median-compensated employee pay ratio has been calculated in accordance with the applicable rules under the Dodd-Frank Wall Street Reform and Consumer Protection Act and is a reasonable estimate calculated in a manner consistent with Item 402(u) of Regulation S-K. Mr. Rowe had 20212023 total compensation of $12,506,622,$10,612,226, which reflects the total compensation reported in the “Summary Compensation Table” in this proxy statement, plus the employer-paid portion of health, vision and dental benefits and disability insurance premiums available to U.S. full-time employees. Our median employee’s annual total compensation for 20212023 was $84,837,$75,833, calculated using the same methodology as used in the calculation of our CEO’s compensation discussed above. As a result, the annual total compensation for our CEO in 20212023 was approximately 147140 timesthat of our median employee’s annual total compensation.

Total target cash compensation was calculated by totaling an employee’s annual base salary and target incentive compensation. We did not make any assumptions, adjustments, or estimates with respect to total target cash compensation. We used total target cash compensation and excluded annual equity awards for our calculations because we do not widely distribute annual equity awards to employees.

After identifying the median employee based on total target cash compensation, we calculated annual total compensation for such employee using the same methodology we use for our Named Executive Officers as set forth in the “Summary Compensation Table” in this proxy statement, except that for purposes of determining our CEO to median compensation employee pay ratio, we included the employer-paid portion of health, vision and dental benefits and disability insurance premiums.

The SEC’s rules for identifying the median compensated employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their employee populations and compensation practices. As a result, the pay ratio reported by other companies may not be comparable to the pay ratio reported above, as other companies have different employee populations and compensation practices and may utilize different methodologies, exclusions, estimates and assumptions in calculating their own pay ratios.

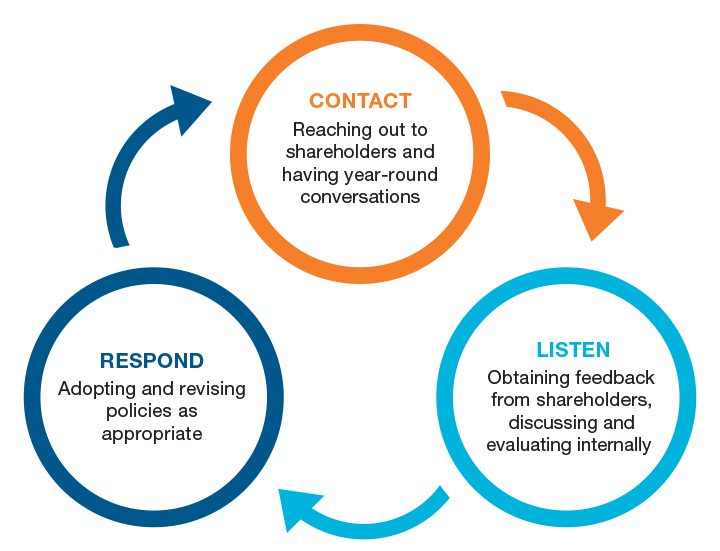

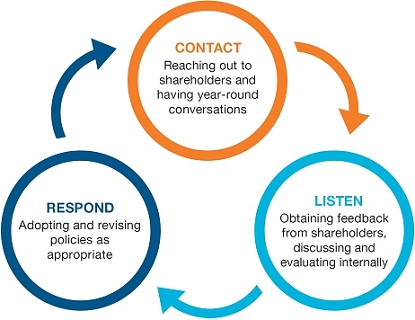

The Board values the opinions of the Company’s shareholders as expressed through their votes and other communications. This Say on Pay vote is advisory, meaning that it is not binding on the O&C Committee or Board. This vote will not affect any compensation already paid or awarded to any Named Executive Officer, nor will it overrule any decisions the Board has made. Nonetheless, the O&C Committee and the Board will review and carefully consider the outcome of the advisory vote on executive compensation when making future decisions regarding our executive compensation programs and policies.

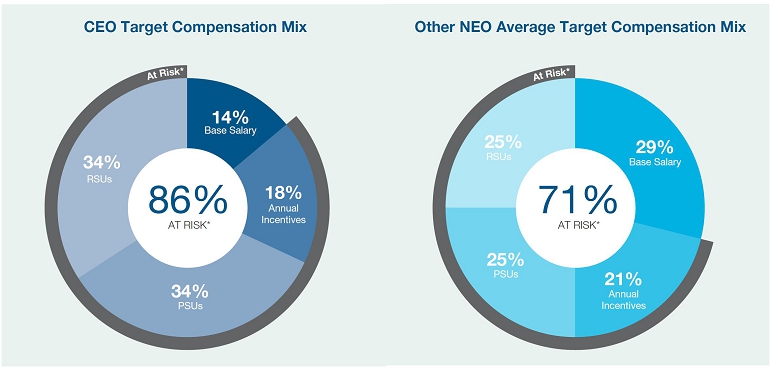

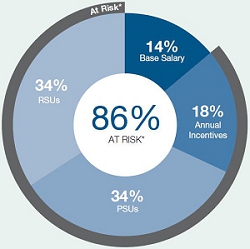

We generally design our executive compensation programs to implement our core objectives of attracting and retaining key leaders, rewarding current performance, driving future performance and aligning the long-term interests of our executives with those of our shareholders. Shareholders are encouraged to read the Compensation Discussion and Analysis (“CD&A”) section of this proxy statement. In the CD&A, we have provided shareholders with a description of our compensation programs, including the philosophy and strategy underpinning the programs, the individual elements of the compensation programs and how our compensation plans are administered.

The Board believes that the Company’s executive compensation programs use appropriate structures and sound pay practices that are effective in achieving our core objectives. Accordingly, the Board recommends that you vote in favor of the following resolution:

The Company has adopted a written policy for approval of transactions between the Company and its directors, director nominees, executive officers, greater-than-5% beneficial owners and their respective immediate family members, where the amount involved in the transaction exceeds or is expected to exceed $120,000 in a single calendar year.

The policy provides that the CG&N Committee reviews transactions subject to the policy and determines whether or not to approve or ratify (in certain limited circumstances where pre-approval was not feasible) those transactions. In doing so, the CG&N Committee takes into account, among other factors it deems appropriate, whether the transaction is on terms that are no less favorable to the Company than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related person’s interest in the transaction. In addition, the Board has delegated authority to the Chairman of the CG&N Committee to pre-approve or ratify transactions (in certain limited circumstances where pre-approval was not feasible) where the aggregate amount involved is expected to be less than $1 million. A summary of any new transactions pre-approved by the Chairman is provided to the full CG&N Committee for its review in connection with each regularly scheduled CG&N Committee meeting.

The CG&N Committee has considered and adopted standing pre-approvals under the policy for limited transactions with related persons. Pre-approved transactions include:

The following shareholders reported to the SEC that they beneficially own more than 5% of the Company’s outstanding common stock. The information is presented as of December 31, 2021,2023, except as noted, and is based on stock ownership reports on Schedule 13G filed with the SEC and subsequently provided to us. We know of no other shareholder holding more than 5% of the Company’s common stock.

We are asking our shareholders to ratify the appointment of PwC as our independent registered public accounting firm.firm for 2024. Although shareholder ratification is not required by our By-Laws or otherwise, the Board is submitting this proposal for ratification because we value our shareholders’ views on the Company’s independent registered public accounting firm and as a matter of good corporate practice. In the event that our shareholders fail to ratify the selection, it will be considered as a direction to the Audit Committee to consider the selection of a different firm, though the Company may nonetheless determine to retain PwC. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

PwC has served as the Company’s independent registered public accounting firm since 2000. In this role, PwC audits the financial statements of the Company. Representatives from PwC are expected to be present at the Annual Meeting and available to respond to appropriate questions from shareholders. They will have the opportunity to make a statement if they desire to do so.

The following table summarizes the aggregate fees (excluding value added taxes) for professional services incurred by the Company for the audits of its 20212023 and 20202022 financial statements and other fees billed to the Company by PwC in 20212023 and 2020.2022. In general, the Company retains PwC for services that are logically related to or natural extensions of services performed by independent auditors.

The Audit Committee approves all proposed services and related fees to be rendered by the Company’s independent registered public accounting firm prior to their engagement. Services to be provided by the Company’s independent registered public accounting firm generally include audit services, audit-related services and certain tax services. Each year, the Audit Committee discusses the scope of the audit plan with its independent registered public accounting firm and all audit and audit-related services, tax services, and other services for the upcoming fiscal year are provided to the Audit Committee for pre-approval. The services, which may be provided in the upcoming twelve-month period, are grouped into significant categories substantially in the format shown above. The Audit Committee is updated on the status of all services and related fees on a periodic basis or more frequently as matters warrant. All of the fees described above were pre-approved by the Audit Committee.

The Audit Committee approves the scope and timing of the external audit plan for the Company and focuses on any matters that may affect the scope of the audit or the independence of the Company’s independent registered public accounting firm. In that regard, the Audit Committee receives certain representations from the Company’s independent registered public accounting firm regarding their independence and permissibility under the applicable laws and regulations of any services provided to the Company outside the scope of those otherwise allowed. The Audit Committee also approves the internal audit plan for the Company.

The Audit Committee may delegate its approval authority to the Chairman of the Audit Committee to the extent allowed by law. In the case of any delegation, the Chairman must disclose all approval determinations to the full Audit Committee as soon as possible after such determinations have been made.

The Audit Committee of the Board of Directors of the Company is composed of four independent directors: Michael C. McMurrayThomas B. Okray (Chairman), Sujeet Chand, Roger L. FixKenneth I. Siegel and Carlyn R. Taylor. John R. Friedery served onMr. Okray joined the Audit Committee until he was replaced by Mr. Fix in August 2021.April 2023. The Audit Committee operates under a written charter adopted by the Board. The Audit Committee met 7 times in 20212023 and discussed matters, explained in more detail below, with the independent auditors, internal auditors and members of management.

Management has primary responsibility for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and issuing a report on this audit. In addition, the independent auditors are responsible for auditing the Company’s internal control over financial reporting and issuing a report on the effectiveness of internal control over financial reporting. The Audit Committee’s responsibility is to proactively monitor and oversee this process, including the engagement of the independent auditors, the pre-approval of their annual audit plan and the review of their annual audit report. In addition, the Audit Committee reviews, monitors and evaluates how the Company and management implement new accounting principles generally accepted in the United States (“GAAP”) and use non-GAAP measures.

In this context, the Audit Committee has met and held detailed discussions with management on the Company’s consolidated financial statements. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with GAAP and that these statements fairly present the financial condition and results of operations of the Company for the period described. The Audit Committee has relied upon this representation without any independent verification, except for the work of PwC, the Company’s independent registered public accounting firm. The Audit Committee also discussed these statements with PwC, both with and without management present, and has relied upon their reported opinion on these financial statements.

The Audit Committee further discussed with PwC matters required to be discussed by standards, including applicable requirements of the PCAOB standards,and the Commission, and critical audit matters. In addition, the Audit Committee received from PwC the written disclosures and letter required by applicable requirements of the PCAOB regarding PwC’s communications with the Audit Committee concerning its independence and has discussed with PwC its independence from the Company and its management.

Based on these reviews and discussions, including the Audit Committee’s specific review with management of the Company’s Annual Report and based upon the representations of management and the report of the independent auditors to the Audit Committee, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report filed with the SEC.

Carlyn R. Taylor

Resolved, Shareholders askrequest that Flowserve provide a report, updated semiannually, disclosing the Company’s:

| 1. | Policies and procedures for making, with corporate funds or assets, contributions and expenditures (direct or indirect) to (a) participate or intervene in any campaign on behalf of (or in opposition to) any candidate for public office, or (b) influence the general public, or any segment thereof, with respect to an election or referendum. |

| 2. | Monetary and non-monetary contributions and expenditures (direct and indirect) used in the manner described in section 1 above, including: |

| (a) | The identity of the recipient as well as the amount paid to each; and |

| (b) | The title(s) of the person(s) in the Company responsible for decision-making |

The report shall be presented to the board of directors or relevant board committee and posted on the Company’s website within 12 months from the date of the annual meeting. This proposal does not encompass lobbying spending.

Supporting Statement

As a long-term shareholder of Flowserve, I support transparency and accountability in corporate electoral spending. This includes any activity considered intervention in a political campaign under the Internal Revenue Code, such as direct and indirect contributions to political candidates, parties, or organizations, and independent expenditures or electioneering communications on behalf of federal, state, or local candidates.

A company’s reputation, value, and bottom line can be adversely impacted by political spending. The risk is especially serious when giving to trade associations, Super PACs, 527 committees, and “social welfare” organizations – groups that routinely pass money to or spend on behalf of candidates and political causes that a company might not otherwise wish to support.

The Conference Board’s 2021 “Under a Microscope” report details these risks, recommends the process suggested in this proposal, and warns “a new era of stakeholder scrutiny, social media, and political polarization has propelled corporate political activity – and the risks that come with it – into the spotlight. Political activity can pose increasingly significant risks for companies, including the perception that political contributions – and other forms of activity – are at odds with core company values”

This proposal asks Flowserve to disclose all of its electoral spending, including payments to trade associations and other tax-exempt organizations which may be used for electoral purposes – and are otherwise undisclosed. This would bring our board to takeCompany in line with a growing number of leading companies, including Fortive Corp., The Boeing Company, and, General Electric Co., which present this information on their websites.

Without knowing the steps necessary to amend the appropriate company governing documents to give the owners of a combined 10%recipients of our outstanding common stock the power to call a special shareholder meeting.

Currently it takes a theoretical 25%company’s political dollars FLS shareholders cannot sufficiently assess whether our company’s election-related spending aligns or conflicts with its policies on climate change and sustainability, or other areas of all shares outstanding to call for a special shareholder meeting.

It goes downhill form here. Shares that are not held for one continuous year are excluded from formal participation in asking for a special shareholder meeting. Thus the shares share that own 25% of the shares that vote at our annual meeting could determine that they own 35% of our shares when length of stock ownership is factored out. Then they could determine that when their shares, not held net long, are included that they own 40% of the shares that vote at our annual meeting.

Thus a theoretical 25% right for 25% of shares to call for a special meeting can in practice easily tum into a 40% right to call a special meeting - nothing for Flowserve management to brag about.

And it keeps going downhill. Flowserve shareholders do not have a practical right to act by written consent. We gave 43% support to a shareholder proposal for a practical right to act by written consent. Instead management in bad faith gave us a precarious “right” to act by written consent.

Management made a rule that in order to act by written consent 25% of shares must petition management for the baby step of obtaining a record date. Once a record date is obtained then shareholders are on a tight schedule to obtaining the consent of 51 % of shares outstanding.

This turns into a classic Catch-22 situation. In order to get a record date, 25% of shares must give their contact information to management.concern. Thus it is easier than shooting fish inwill be a barrelbest practice for managementFLS to pester the 25% of shares to change their mind and revoke their support for their written consent topic.expand its political spending disclosure.

Thus while the base of 25% of shares are easily venerable to management attack by deep pockets company money, shareholders must double their number to 51 % of shares in a limited time period.

We need an improved right to call for a special shareholder meeting to make up for its current severe limitation and to make up for the fact that we have a precarious right to act by written consent.

Please vote yes:

Special Shareholder Meeting Improvement – Proposal 4

| 2024 PROXY STATEMENT |  | 80 |

2022 PROXY STATEMENT  73

73

Back to Contents

Recommendation of the Board

The Board has carefully considered this proposal and believes that it is unnecessary and not in the best interests of our shareholders. Consequently, the Board UNANIMOUSLY recommends that shareholdersa vote AGAINST this proposal for the advisory proposal requestingfollowing reasons.

The Company Does Not Make Political Contributions And Our Political Activities Policy Is Subject to Oversight By The Board’s Corporate Governance and Nominating Committee.

For over ten years, the Company has not contributed any corporate money to political campaigns or political organizations, and the Company does not have a Company-sponsored political action committee (PAC). This is in keeping with our stated long-standing position that the BoardCompany is a non-partisan corporation that does not actively engage in the political process. As described in our Political Activities Policy which is located at www.flowserve.com under the “Corporate Governance” section, the Company will not use corporate funds or assets to make direct or indirect political contributions (as described in the policy), except with respect to dues paid to trade associations and other tax-exempt organizations who may use such dues for political activity purposes. In addition, no Company director, officer or employee is permitted to make political contributions on behalf of or for the Company.

Our Political Activities Policy is overseen by the Board’s CG&N Committee. In addition, management reports to the CG&N Committee on the Company’s compliance with the policy at least annually.

The Proposal Is Unnecessary Because Even If The Company Did Participate In The Political Process, Such Political Expenditures Would Be Disclosed As Required By Law.

Political contributions of all types are subject to extensive governmental regulation and public disclosure requirements. Election laws at both the federal and state level require either the contributor or the recipient campaign or committee to publicly file reports disclosing such contributions. Those disclosures are aggregated by a number of independent and non-partisan groups and are available and easily searchable on public websites, making the report requested by this proposal unnecessary.

In accordance with federal law, corporations cannot use corporate funds to make direct contributions to candidates for federal political office. While the Company does not currently actively participate in the political process, whether through contributions to political parties, candidates or political organizations or electioneering activity, if it were to do so, it would do so in full compliance with all applicable disclosure laws, as required under our Political Activities Policy.

The Cost And Effort Of Providing The Additional Information Requested By This Proposal Would Significantly Exceed The Value Such Information Would Have To Our Shareholders.

As described above, the Company does not currently actively participate in the political process. However, as noted in our Political Activities Policy, the Company does participate in various industry groups and trade associations that further our business, economic and community interests. The industry groups and trade associations of which we are a member help keep the Company informed of developments and trends in the manufacturing industry and issues important to the Company as a global company and employer. These organizations may support their member companies through educational forums, political activities and advocacy to advance issues of common concern to the industrial manufacturing industry or the business community at large. These industry groups or trade associations may also take stepspolitical or policy positions we do not share, and that are not directly attributable to modifythe membership dues we pay. The Company reviews these memberships annually to assess their business value and their alignment with our shareholders’ existing abilityoverall public policy agenda.

As discussed in our Political Activities Policy, the Company seeks to call special meetings becausepromote transparency regarding the activities of such industry groups and trade associations in which we participate. Accordingly, we already provide voluntarily annual disclosure regarding the portion of payments to any such U.S.-based organizations that the organization reports as being used for political activity purposes where the Company’s total annual payments to the organization are $100,000 or greater. As a result, we already provide meaningful disclosure to our shareholders and other stakeholders regarding the extent to which our membership dues to trade associations and industry groups may be used for political purposes.

The proposal would mandate additional granular disclosure regarding all payments to trade associations and other tax-exempt organizations that may be used for electoral purposes. We believe this additional disclosure is unnecessary and would not provide decision-useful information to our shareholders. It can be difficult to assess exactly how dues paid to such organizations could be used, which would make it difficult to comply with the reporting requirements of this proposal and require further corporate expenditures with little return for our shareholders. Therefore, we do not believe that the benefit of the requested report outweighs the resources required to prepare such a report.

| 2024 PROXY STATEMENT |  | 81 |

Thus, after careful consideration of the proposal, the Board has concluded that the additional disclosure mandated by the report is unnecessary, as the Company has already clearly and publicly stated that it does not actively engage in the political process. The Company already provides meaningful disclosure regarding our policies and procedures regarding political activities and our participation in trade associations and other organizations. Moreover, our Political Activities Policy is subject to direct oversight by the Board’s CG&N Committee. Accordingly, the Board believes providing the additional information requested by the proposal would also not be an efficient use of the Company’s resources or be in the best interest of the Company or its shareholders. The Board believes that shareholders’ existing special meeting rights, together with the Company’s strong corporate governance policies and practices, already provide shareholders with a meaningful ability to call a special meeting, as well as meaningful opportunities to interact with the Board and senior management. Moreover, the lowered threshold would not be in accordance with predominant best practice, would not appropriately balance competing shareholder interests, and could result in unnecessary expenditure of Company time and resources. The Board also believes that this proposal is unnecessary in light of our robust corporate governance practices and record of Board accountability. Accordingly, the Board recommends that you vote “AGAINST” Proposal 4 for the following reasons:

Our Shareholders Already Have a Meaningful Right to Call Special Meetings, and the Current Threshold Strikes a Balance that Protects the Interests of Long-Term Shareholders.

Our governing documents currently provide our shareholders with a meaningful and balanced right to call special meetings and the proposed decrease in percentage of shares required to call a special meeting is neither necessary nor in the best interest of the Company and its shareholders. Currently, shareholders holding in the aggregate at least 25% of the outstanding shares of the Company’s common stock on a “net long” basis may request a special meeting. The Board continues to believe that this threshold, which is the most common threshold among S&P 500 companies, strikes an appropriate balance between providing shareholders holding a meaningful minority of our outstanding shares a mechanism to call a special meeting when particularly urgent or strategic matters of importance arise, while also protecting shareholders against the imprudent use of Company resources to address special interests.

Special Meetings Require a Substantial Investment of Time and Resources.

Convening a special meeting of shareholders requires a significant commitment of Company time and resources and would divert Board and management time away from overseeing the day-to-day operations of the Company. Accordingly, given the substantial burdens and costs, special meetings should be limited to extraordinary events and circumstances. By reducing the ownership threshold as requested, a small minority of shareholders, including in some cases a single shareholder, could use the special meeting mechanism to advance their own narrower agenda, without regard to the broader interests of the Company and its other shareholders. The Board continues to believe that our existing special meeting threshold, which affords shareholders a full and meaningful opportunity to call a special meeting, effectively balances these concerns.

The Company Has a Demonstrated Commitment to Shareholder Engagement and Strong and Effective Corporate Governance Practices that Promote Accountability.

The Board believes that shareholders should evaluate this proposal in the context of the Company’s robust shareholder engagement efforts, along with our strong corporate governance policies that reflect the Company’s ongoing commitment to effective governance practices and accountability to our shareholders. We encourage and facilitate regular communication with large and small shareholders about important issues relating to our business and governance and regularly incorporate feedback from those engagements into our governing documents, policies, and practices. For example, in fiscal year 2021, we solicited feedback from shareholders representing approximately 80% of our outstanding shares, seeking input on compensation and governance matters. Notably, during our recent engagement, no other shareholders identified the Company’s existing special meeting threshold as a concern.

2022 PROXY STATEMENT  74

74

Back to Contents

Further, we have implemented numerous corporate governance measures, including through Board-adopted By-law amendments, that provide shareholders with the opportunity to have a meaningful voice in the Company’s governance. For example:

•

All directors are elected annually by a majority of the votes cast in uncontested elections, and our director resignation policy requires directors to offer to resign if they fail to receive a majority of the votes cast in an uncontested election;

•

8 of our 9 directors standing for election at the 2022 Annual meeting are independent, and our Board is led by an independent Chairman with clearly defined, robust responsibilities;

•

Shareholders have a meaningful, market-standard proxy access right that permits them to include their director nominees in the Company’s proxy statement, subject to compliance with the applicable By-law requirements;

•

Shareholders have the right to recommend a candidate for election to the Board, and the Corporate Governance and Nominating Committee evaluates such recommendations using generally the same methods and criteria as recommendations received from other sources; and

•

Shareholders have a meaningful right to act by written consent, subject to compliance with the applicable Restated Certificate of Incorporation and By-law requirements.

For these reasons, the Board continuesunanimously urges shareholders to believe that it is not necessary or in our shareholders’ best interestvote AGAINST the proposal to modify our existing special meeting threshold, which provides appropriateprepare a report disclosing additional information regarding the Company’s political spending and reasonable limitations on the right to call a special meeting.related policies and procedures.

| 2024 PROXY STATEMENT |  | 82 |

2022 PROXY STATEMENT  75

75

Back to Contents

The Company knows of no other matters to be submitted to the shareholders at the Annual Meeting. If any other matters are properly brought before the shareholders at the Annual Meeting, it is the intention of the persons named on the enclosed proxy card to vote the shares represented thereby on such matters in accordance with their best judgment.

| 2024 PROXY STATEMENT |  | 83 |

2022 PROXY STATEMENT  76

76

Back to Contents

Proxy Materials

Why am I receiving this proxy statement?

We are first providing these proxy materials to shareholders beginning on March 31, 2022,or about April 2, 2024, in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting, which will be held on May 12, 2022,16, 2024, and at any adjournments or postponements of this scheduled meeting.

How can I access the proxy materials electronically or sign up for electronic delivery?

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 12, 202216, 2024

We may furnish proxy materials, including this proxy statement and the Company’s annual report for the year ending December 31, 2021,2023, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”), which was mailed to most of our shareholders, will explain how you may access and review the proxy materials and how you may submit your proxy on the Internet. If you would like to receive a paper or electronic copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability. Shareholders who requested paper copies of proxy materials or previously elected to receive proxy materials electronically did not receive the Notice of Internet Availability and are receiving the proxy materials in the format requested.

This proxy statement and the Company’s annual report for the year ending December 31, 2021,2023, are available electronically on our hosted website at www.proxyvote.comhttps://www.proxyvote.com..

To access and review the materials made available electronically:

1.

Go to www.proxyvote.com and input the 16-digit control number from the Notice of Internet Availability or proxy card.

2.

| 1. | Go to https://www.proxyvote.com and input the 16-digit control number from the Notice of Internet Availability or proxy card. |

| 2. | Click the “2024 Proxy Statement” in the right column. |

| 3. | Have your proxy card or voting instructions available. |

Click the “2022 Proxy Statement” in the right column.

3.

Have your proxy card or voting instructions available.

We encourage you to review all of the important information contained in the proxy materials before voting.

Who will bear the cost of this solicitation, and how will proxies be solicited?

The Company bears the full cost of soliciting proxies, which will be conducted primarily by mail. The Company has also retained Alliance Advisors to aid in the solicitation of proxies by mail, telephone, facsimile, e-mail and personal solicitation and will request brokerage houses and other nominees, fiduciaries and custodians to forward soliciting materials to beneficial owners of the Company’s common stock. For these services, the Company will pay Alliance Advisors a fee of $9,500$12,500 plus reimbursement for reasonable out-of-pocket expenses. Brokerage firms and other custodians, nominees and fiduciaries are reimbursed by the Company for reasonable out-of-pocket expenses that they incur to send proxy materials to shareholders and solicit their votes. In addition to this mailing, proxies may be solicited, without extra compensation, by our officers and employees, by mail, telephone, facsimile, electronic mail and other methods of communication.

Why did my household only receive one set of proxy materials?

To reduce the expenses of delivering duplicate proxy materials, we deliver one Notice of Internet Availability and, if applicable, annual report and proxy statement, to multiple shareholders sharing the same mailing address unless otherwise requested. We will promptly send a separate annual report and proxy statement to a shareholder at a shared address upon request at no cost. Shareholders with a shared address may also request that we send a single copy in the future if we are currently sending multiple copies to the same address.

2022 PROXY STATEMENT  77

77

Back to Contents

Requests related to delivery of proxy materials may be made by calling Investor Relations at (972) 443-6500 or writing to our principal executive offices at Flowserve Corporation, Attention: Investor Relations, 5215 N. O’Connor Blvd., Suite 700, Irving, Texas 75039. Shareholders who hold shares in “street name” (as described below) may contact their brokerage firm, bank, broker-dealer or similar organization to request information about this “householding” procedure.

| 2024 PROXY STATEMENT |  | 84 |

Voting

Who may vote?

Shareholders of record at the close of business on March 16, 202218, 2024 (the “Record Date”) are entitled to vote at the Annual Meeting. As of the Record Date, 130,640,880131,740,713 shares of common stock were issued and outstanding (excluding treasury shares). Each shareholder is entitled to one vote for each share owned.

What are the voting requirements and the Board’s recommendations on each proposal?

The following table sets forth the voting standards for each proposal being voted on at the Annual Meeting and the Board’s recommendations.

Proposal

| Board

Recommendation

| Required Vote

| Effect of...of… |

Abstentions

Proposal | Board

Recommendation | Required Vote | Abstentions | Broker Non-votes

Non-votes,

if any |

| For each nominee | Majority of the votes cast | No effect | No effect |

2. Advisory vote to approve executive compensation | For | Majority of the votes cast | No effect | No effect |

3. Ratification of auditors | For | Majority of the votes cast | No effect | Not applicable

N/A |

| Approval of employee stock purchase plan | Against

For | Majority of the votes cast | No effect | No effect |

| 5. Shareholder proposal | Against | Majority of the votes cast | No effect | No effect |

Shares that are properly voted via the Internet or by telephone or for which proxy cards are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted in accordance with the Board’s recommendations above. Although the Board expects that the nominees will be available to serve as directors, if any of them should be unable or for good cause unwilling to serve, the Board may decrease the size of the Board or may designate substitute nominees, and the proxies will be voted in favor of any such substitute nominees.

The Company knows of no other matters to be submitted to the shareholders at the Annual Meeting. If any other matters properly come before the shareholders at the Annual Meeting, it is the intention of the persons named on the enclosed proxy card to vote the shares represented thereby on such matters in accordance with their best judgment.

What is athe effect of abstentions and broker non-vote?non-votes?

If your shares are held through a broker, bank or other nominee, your vote instructs the brokerthese institutions how you want your shares to be voted. If you vote on each proposal, your shares will be voted in accordance with your instructions. Under the rules of the NYSE,If brokers, banks or other nominees do not receive specific instructions, they may only vote shareson matters for which they hold in “street name” on behalf of beneficial owners who have discretionary power to vote. If you do not voted with respect to certain discretionary matters. The proposal to ratify the appointment of PricewaterhouseCoopers LLP (Proposal Three) is considered a discretionary matter, so brokers may vote shares on this matter in their discretion if noprovide voting instructions are received. However, theand your broker, bank or other proposals are NOT considered discretionary matters, so brokersnominee does not have no discretion to vote shareson the matter, it will result in a “broker non-vote” for the matters on which no voting instructions are received, and nothey do not vote. Your broker, bank or other nominee is not permitted to vote will be caston your behalf in the election of directors (Proposal 1), the advisory vote to approve executive compensation (Proposal 2), the approval of the employee stock purchase plan (Proposal 4), or the approval of the shareholder proposal regarding political spending (Proposal 5). Accordingly, if you do not provide timely instructions to your broker, bank or other nominee that holds your shares, that institution will be prohibited from voting on all the proposals in its discretion, except the ratification of the appointment of the independent auditor (Proposal 3). Abstentions occur when you provide voting instructions but instruct your broker, bank other other nominee to abstain from voting on a particular matter instead of voting for or against the matter. Abstentions are not considered as votes cast and will not be counted in determining the outcome of the vote on those items (this is commonly referred to as a “broker non-vote”).the election of directors or on any of the other proposals. We therefore urge you to vote on ALL voting items.

What constitutes a quorum?

A quorum is necessary to conduct business at the Annual Meeting. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of common stock constitutes a quorum. Abstentions, withheld votes, and broker non-votes are counted as present at the meeting for purposes of determining a quorum.

2022 PROXY STATEMENT  78

78

| 2024 PROXY STATEMENT |  | 85 |

Back to Contents

How do I vote?

If your shares are held by a broker, bank or other nominee (i.e., in “street name”), you will receive instructions from your nominee, which you must follow in order to have your shares voted. “Street name” shareholders who wish to vote online during the Annual Meeting and whose voting instruction form or Notice of Internet Availability indicates that they may vote those shares through https://www.proxyvote.commay attend and vote at the Annual Meeting at https://www.virtualshareholdermeeting.com/FLS2022FLS2024 by entering the 16-digit control number indicated on that voting instruction form or Notice of Internet Availability and other information requested on the log-in page. “Street name” shareholders who did not receive a 16-digit control number should contact their bank, broker or other nominee at least five days before the Annual Meeting and obtain a “legal proxy” to be able to participate in or vote online at the meeting.

If you hold your shares in your own name as a holder of record,, you may vote your shares using one of the methods described below:

•

Vote by Internet in Advance of the Annual Meeting. You can vote via the Internet by going to www.proxyvote.com and following the on-screen instructions. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on May 11, 2022. Have your proxy card available when you access the Internet website.

•

| • | Vote by Internet in Advance of the Annual Meeting. You can vote via the Internet by going to https://www.proxyvote.com and following the on-screen instructions. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on May 15, 2024. Have your proxy card available when you access the Internet website. |

| • | Vote by Telephone in Advance of the Annual Meeting. If you received paper copies of the proxy materials, you can vote by telephone by calling toll-free to 1-800-690-6903 from the United States and Canada and following the voice instructions. Have your proxy card available when you place your telephone call. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on May 15, 2024. |

| • | Vote by Mail in Advance of the Annual Meeting. If you received paper copies of the proxy materials, you may mark the enclosed proxy card, sign and date it and return it to Broadridge in the enclosed envelope as soon as possible before the Annual Meeting. Your signed proxy card must be received by Broadridge prior to May 16, 2024, the date of the Annual Meeting for your vote to be counted at the Annual Meeting. Please note that if you vote by Internet or telephone, you do not need to return a proxy card. |

| • | Vote Online During the Annual Meeting. You may attend the Annual Meeting virtually and vote online at https:// www.virtualshareholdermeeting.com/FLS2024 by entering the 16-digit control number provided on your proxy card, voting instruction form or Notice of Internet Availability and other information requested on the log-in page. |

Vote by Telephone in Advance of the Annual Meeting. If you received paper copies of the proxy materials, you can vote by telephone by calling toll-free to 1-800-690-6903 from the United States and Canada and following the voice instructions. Have your proxy card available when you place your telephone call. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on May 11, 2022.

•

Vote by Mail in Advance of the Annual Meeting. If you received paper copies of the proxy materials, you may mark the enclosed proxy card, sign and date it and return it to Broadridge in the enclosed envelope as soon as possible before the Annual Meeting. Your signed proxy card must be received by Broadridge prior to May 12, 2022, the date of the Annual Meeting for your vote to be counted at the Annual Meeting. Please note that if you vote by Internet or telephone, you do not need to return a proxy card.

•

Vote Online During the Annual Meeting. You may attend the Annual Meeting virtually and vote online at www.virtualshareholdermeeting.com/FLS2022 by entering the 16-digit control number provided on your proxy card, voting instruction form or Notice of Internet Availability and other information requested on the log-in page.

How do I vote if I participate in the Flowserve Corporation Retirement Savings Plan?

If you are a participant in the Flowserve Corporation Retirement Savings Plan, your vote serves as a voting instruction to the trustee for this plan.

•

To be timely, your vote by telephone or Internet must be received by 11:59 p.m., Eastern Time, on May 9, 2022. If you do not vote by telephone or Internet, please return your proxy card as soon as possible.

•

| • | To be timely, your vote by telephone or Internet must be received by 11:59 p.m., Eastern Time, on May 13, 2024. If you do not vote by telephone or Internet, please return your proxy card as soon as possible. |

| • | If you vote in a timely manner, the trustee will vote the shares as you have directed. |

| • | If you do not vote in a timely manner, the trustee will vote your shares in the same proportion as the shares voted by participants who timely return their cards to the trustee. |

If you vote in a timely manner, the trustee will vote the shares as you have directed.

•

If you do not vote in a timely manner, the trustee will vote your shares in the same proportion as the shares voted by participants who timely return their cards to the trustee.

How can I change my vote?

You may revoke your proxy at any time before it has been exercised at the Annual Meeting by:

•

timely mailing in a revised proxy dated later than the prior submitted proxy;

•

| • | timely mailing in a revised proxy dated later than the prior submitted proxy; |

| • | timely notifying the Corporate Secretary in writing that you are revoking your proxy; |

| • | timely casting a new vote by telephone or the Internet; or |

| • | attending the Annual Meeting virtually and voting online (and by following the instructions under “How do I vote?”, including by entering your 16-digit control number). |

timely notifying the Corporate Secretary in writing that you are revoking your proxy;

•

timely casting a new vote by telephone or the Internet; or

•

attending the Annual Meeting virtually and voting online (and by following the instructions under “How do I vote?”, including by entering your 16-digit control number).

Who will count the votes?

Broadridge, our independent inspector of elections for the Annual Meeting, will tabulate voted proxies.

2022 PROXY STATEMENT  79

79

| 2024 PROXY STATEMENT |  | 86 |

Back to Contents

How can I attend the Annual Meeting online?

Shareholders as of the record date will be able to participate in the Annual Meeting virtually. Shareholders attending the Annual Meeting will have the opportunity to cast their votes online during the meeting, by following the instructions provided under “How do I vote?” and ask questions of management and our directors during the question and answer portion of the Annual Meeting, as described under “May I ask questions prior to or during the Annual Meeting?”. Online check-in will be available approximately 15 minutes before the meeting starts. We encourage you to allow ample time for check-in procedures.

A guest log-in option will be available in listen-only mode. Anyone wishing to do so may go to https://www.virtualshareholdermeeting.com/FLS2022FLS2024 and enter as a guest. Shareholders who attend the Annual Meeting online as a guest will not be able to participate in, vote or ask questions during the Annual Meeting.

We will also broadcast the Annual Meeting as a live audio webcast at www.flowserve.comir.flowserve.com under the “Investors—“Events & Presentations” section.

May I ask questions prior to or during the Annual Meeting?

Shareholders as of the record date that receive a 16-digit code on their proxy card, voting instruction form or Notice of Internet Availability (including “street name” shareholders who subsequently obtain a legal proxy and 16-digit control number) may submit questions in advance of the meeting, beginning on April 28, 2022,May 11, 2024, by following the instructions at https://www.proxyvote.com.

Shareholders as of the record date who attend and participate in the virtual Annual Meeting at https://www.virtualshareholdermeeting.com/FLS2022FLS2024 using their 16-digit control number (as described above) will have an opportunity to submit questions online during the meeting. Shareholders attending the meeting online who do not log-in to the virtual meeting portal with their 16-digit control number and other information requested on the log-in page may not ask questions or vote their shares during the meeting.

Beginning on April 28, 2022,May 2, 2024, we will post meeting rules of conduct at https://www.proxyvote.com, which will set out the rules that will govern shareholders’ participation in the Annual Meeting. The rules of conduct will provide that each shareholder will be limited to a total of three questions of no more than one minute each in order to allow sufficient time to address as many relevant questions that are submitted as possible. We will answer questions relevant to meeting matters that comply with the meeting rules of conduct during the Annual Meeting, subject to time constraints.

Questions related to personal matters, that are not pertinent to Annual Meeting matters, or that contain derogatory references to individuals, use offensive language, or are otherwise out of order or not suitable for the conduct of the Annual Meeting will not be addressed during the meeting. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. If there are questions pertinent to Annual Meeting matters that cannot be answered during the Annual Meeting due to time constraints, management will post answers to such questions at https://ir.flowserve.comfollowing the meeting.

What if I have technical difficulties or trouble accessing the virtual Annual Meeting website?

If you encounter any technical difficulties with the virtual meeting website on the meeting day, please call the technical support number that will be posted on the virtual meeting log-in page. Technical support will be available starting at 11:00 a.m. central daylight timeCDT and until the meeting has finished.

What if I was not able to attend the Annual Meeting?

A replay of the meeting will be made available on our website at www.flowserve.comhttps://ir.flowserve.com under the “Investors—“Events & Presentations” section after the meeting.

Where can I find the voting results after the Annual Meeting?

We intend to announce the preliminary voting results of the proposals at the Annual Meeting and to disclose final voting results in a Form 8-K to be filed with the SEC no later thanwithin four business days following the Annual Meeting (or, if final results are not available at the time, within four business days of the date on which final results become available).

2022 PROXY STATEMENT  80

80

| 2024 PROXY STATEMENT |  | 87 |

Back to Contents

How can I reach the Company to request materials or information referred to in these Questions and Answers?

You may order a copy of our Annual Report on Form 10-K10-K for the fiscal year ended December 31, 2021,2023, free of charge, or request other information by mail addressed to:

Flowserve Corporation

5215 N. O’Connor Blvd.

Suite 700

Irving, Texas 75039

Attention: Investor Relations

This information is also available free of charge on the SEC’s website, https://www.sec.gov, and our website, www.flowserve.comhttps://ir.flowserve.com.

Shareholder Proposals and Nominations

Shareholder Proposals for Inclusion in the 20232025 Proxy Statement (Rule 14a-814a-8 Proposals)

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), certain shareholder proposals may be eligible for inclusion in our 20222025 proxy statement. These shareholder proposals must comply with the requirements of Rule 14a-8, including a requirement that shareholder proposals be received no later than 6:00 p.m. CDT on December 1, 2022.3, 2024. All proposals should be addressed to the Corporate Secretary at the address below. We strongly encourage any shareholder interested in submitting a proposal to contact the Corporate Secretary in advance of this deadline to discuss the proposal. Submitting a shareholder proposal does not guarantee that we will include it in our proxy statement.

Director Nominees for Inclusion in the 20232025 Proxy Statement (Proxy Access)

In order for an eligible shareholder or group of shareholders to nominate a director nominee for election at our 20232025 Annual Meeting of shareholders pursuant to the proxy access provision of our By-Laws, the shareholder must submit notice of such nomination and other required information in writing between November 1, 20223, 2024 and December 1, 2022.3, 2024. If, however, the 20232025 Annual Meeting is held more than 30 days before or more than 60 days after the anniversary of the 20222024 Annual Meeting, the shareholder must submit any such notice and other required information between (i) 150 calendar days prior to the 20232025 Annual Meeting and (ii) the later of 120 calendar days prior to the 20232025 Annual Meeting or 10 days following the date on which the date of the 20232025 Annual Meeting is first publicly announced. The nomination and supporting materials must also comply with the requirements set forth in our By-Laws for inclusion of director nominees in the proxy statement.

Other Shareholder Proposals/Nominees to be Presented at the 20232025 Annual Meeting

Alternatively, under the Company’s By-Laws, if a shareholder does not want to submit a proposal for inclusion in our proxy statement but wants to introduce it at our 20232025 Annual Meeting, or intends to nominate a person for election to the Board directly (rather than by inclusion in our proxy statement or by recommending such person as a candidate to our CG&N Committee) the shareholder’s notice must be delivered to the Corporate Secretary at the address below no earlier than January 12, 202316, 2025 and no later than February 11, 2023.15, 2025. If, however, the 20232025 Annual Meeting is held more than 30 days before or more than 60 days after the anniversary of the 20222024 Annual Meeting, the shareholder must submit any such notice between (i) 120 calendar days prior to the 20232025 Annual Meeting and (ii) the later of 90 calendar days prior to the 20222025 Annual Meeting or 10 days following the date on which the date of the 20232025 Annual Meeting is publicly announced.

The shareholder’s submission must be made by a registered shareholder on his or her behalf or on behalf of a beneficial owner of the shares and must include detailed information specified in our By-Laws concerning the proposal or nominee, as the case may be, and detailed information as to the shareholder’s interests in Company securities. In addition, the deadline for providing notice to the Company under Rule 14a-9,14a-19, the SEC’s universal proxy rule, of a shareholder’s intent to solicit proxies in support of nominees submitted under the Company’s advance notice bylaws is March 13, 2023.17, 2025 (or, if the 2025 Annual Meeting is called for a date that is more than 30 days before or more than 30 days after such anniversary date, then notice must be provided not later than the close of business on the later of 60 calendar days prior to the 2025 Annual Meeting or the 10th calendar day following the day on which public announcement of the 2025 Annual Meeting is first made by the Company). The notice requirement under Rule 14a-19 is in addition to the applicable advance notice requirements under our By-Laws as described above.

| 2024 PROXY STATEMENT |  | 88 |

At the 20232025 Annual Meeting, we will not entertain any proposals or nominations that do not meet these requirements other than shareholder nominations eligible to be included in our 20232025 proxy statement as described above.

2022 PROXY STATEMENT  81

81

Back to Contents

If the shareholder does not comply with the requirements of Rule 14a-4(c)(1) under the Exchange Act, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our best judgment on any such shareholder proposal or nomination. The Company’s By-Laws are posted on the investor relations portion of our website at https://ir.flowserve.comunder the “Corporate Governance—Documents & Charters” caption. To make a submission or to request a copy of the Company’s By-Laws, shareholders should contact our Corporate Secretary at our principal executive offices at the following address:

Flowserve Corporation

5215 N. O’Connor Blvd.

Suite 700

Irving, Texas 75039

Attention: Corporate Secretary

We strongly encourage shareholders to seek advice from knowledgeable legal counsel and contact the Corporate Secretary before submitting a proposal or a nomination.

This Proxy Statement contains forward-looking statements about future events

Standards of measurement and circumstances. Generally speaking, any statement not based upon historical fact is a forward-looking statement. Forward-looking statements can also be identified by the use of forward-looking or conditional words such as “could,” “should,” “can,” “continue,” “estimate,” “intent,” “forecast,” “intend,” “look,” “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “remain,” “project,” “predict,” “seek,” “confident” and “commit” or similar expressions. In particular, statements regardingperformance made in reference to our financial position, plans, strategies, objectives, prospects and expectations regarding our business, future operations, industry and market conditions are forward-looking statements. They reflect our current expectations, are subject to materials risks, uncertaintiesenvironmental, social, governance and other factors, many ofsustainability plans and goals may be based on evolving protocols and assumptions which are outside of our control, and are not guarantees of performance and speak only as of the date of this Proxy Statement. You should not rely unduly on forward-looking statements. Our business results are subject to a variety of risks and uncertainties, including those that are described in our 2021 Annual Report on Form 10-K and elsewhere in our filings with the Securities and Exchange Commission, any of which could cause actual plans or results to differ materially from those included in any forward-looking statements. If any of these considerations or risks materialize or intensify, our expectations (or underlying assumptions) may change and our performance mayor be adversely affected. Except as required by law, we undertake no obligation, and disclaim any duty, to publicly update or revise any forward-looking statement or disclose any facts, events or circumstances that O&C Committeeur after the date hereof that may affect the accuracy of any forward-looking statement, whether as a result of new information, future events, changes in our expectations or otherwise.refined.

Additionally, website links included in this Proxy Statement are for convenience only. Information contained on or accessible through such website links is not incorporated herein and does not constitute a part of this Proxy Statement.

| 2024 PROXY STATEMENT |  | 89 |

2022 PROXY STATEMENT  82

82

Back to Contents

RECONCILIATION OF REPORTED RESULTS TO NON-GAAP FINANCIAL MEASURES

RECONCILIATION OF NON-GAAP MEASURES (Unaudited)

Twelve Months Ended

December 31, 2023

(Amounts in thousands,

except per share data) | | Gross

Profit | | Selling,

General &

Administrative

Expenses | | Operating

Income | | Other

Income

(Expense),

Net | | Provision

For

(Benefit

From)

Income

Taxes | | Net Earnings

Attributable to

Noncontrolling

Interests | | Net

Earnings

(Loss) | | Effective

Tax Rate | | Diluted

EPS |

| Reported | | $ | 1,276,828 | | 961,169 | | 333,553 | | (49,870) | | 18,562 | | 18,445 | | 186,743 | | 8.3% | | $ | 1.42 |

| Reported as a percent of sales | | | 29.6% | | 22.2% | | 7.7% | | -1.2% | | 0.4% | | 0.4% | | 4.3% | | | | | |

| Realignment charges(1) | | | 21,012 | | (45,025) | | 66,037 | | — | | 14,949 | | — | | 51,088 | | 22.6% | | | 0.39 |

| Discrete asset write-downs(2)(3)(4)(5) | | | 715 | | (3,955) | | 4,670 | | 2,000 | | 1,611 | | — | | 5,059 | | 24.2% | | | 0.04 |

| Acquisition related(6) | | | — | | (7,247) | | 7,247 | | — | | 1,704 | | — | | 5,543 | | 23.5% | | | 0.04 |

| Below-the-line foreign exchange impacts(7) | | | — | | — | | — | | 41,092 | | 2,395 | | — | | 38,697 | | 5.8% | | | 0.29 |

| Correction of prior period errors(8) | | | — | | — | | — | | — | | — | | (3,559) | | 3,559 | | 0.0% | | | 0.03 |

| Discrete tax benefit(9) | | | — | | — | | — | | — | | 13,000 | | — | | (13,000) | | 0.0% | | | (0.10) |

| Adjusted | | $ | 1,298,555 | | 904,942 | | 411,507 | | (6,778) | | 52,221 | | 14,886 | | 277,689 | | 15.1% | | $ | 2.10 |

| Adjusted as a percent of sales | | | 30.1% | | 20.9% | | 9.5% | | -0.2% | | 1.2% | | 0.3% | | 6.4% | | | | | |

| Adjusted Net Earnings (Loss) | | $ | 277,689(a) | | | | | | | | | | | | | | | | | |

| Operating cash flow | | | 325,772 | | | | | | | | | | | | | | | | | |

| Less: Capital expenditures | | | (67,359) | | | | | | | | | | | | | | | | | |

| Free cash flow | | $ | 258,413(b) | | | | | | | | | | | | | | | | | |

| As adjusted free cash flow conversion rate (b)/(a) | | | 93% | | | | | | | | | | | | | | | | | |

Notes:

| Note: | Amounts may not recalculate due to rounding. |

| (1) | Charges represent realignment costs incurred as a result of realignment programs of which $9,701 is non-cash. |

| (2) | Charge represents a further expense of $1,834 associated with a sales contract that was initially adjusted out of Non-GAAP measures in 2017. |

| (3) | Includes reversals of expenses that were adjusted for Non-GAAP measures in previous periods of $81. |

| (4) | Charge represents a $2,917 non-cash write-down of a licensing agreement. |

| (5) | Charge represents a non-cash asset write-down of $2,000 associated with the impairment of an equity investment. |

| (6) | Charges represent costs associated with a terminated acquisition. |

| (7) | Below-the-line foreign exchange impacts represent the remeasurement of foreign exchange derivative contracts as well as the remeasurement of assets and liabilities that are denominated in a currency other than a site’s respective functional currency. |

| (8) | Represents the amount to correct the cumulative impact of immaterial prior period errors. |

| (9) | Represents a discrete tax benefit due to release of tax valuation allowance on the net deferred tax assets in a foreign jurisdiction. The associated tax expense was adjusted out on Non-GAAP measures in 2015. |

| | |

| 2024 PROXY STATEMENT |  | 90 |

RECONCILIATION OF NON-GAAP MEASURES (Unaudited)

(Amounts in thousands,

except per share data) | Year Ended December 31, 2021 |

As Reported | Realignment(1) | Other Items | As Adjusted | |

Sales | $ | 3,541,060 | $ | — | | $ | — | | $ | 3,541,060 | |

Gross profit | | 1,049,725 | | (16,844) | | | — | | | 1,066,568 | |

Gross margin | | 29.6% | | — | | | — | | | 30.1% | |

Selling, general and administrative expense | | (797,076) | | (5,646) | | | — | | | (791,431) | |

Gain on sale of business | | 1,806 | | — | | | 1,806 | (3) | | — | |

Net earnings from affiliates | | 16,304 | | — | | | — | | | 16,304 | |

Operating income | | 270,759 | | (22,490) | | | 1,806 | | | 291,441 | |

Operating income as a percentage of sales | | 7.6% | | — | | | — | | | 8.2% | |

Interest and other expense, net | | (137,171) | | — | | | (75,188) | (4) | | (61,982) | |

Earnings before income taxes | | 133,588 | | (22,490) | | | (73,382) | | | 229,459 | |

(Provision for) benefit from income taxes | | 2,594 | | 7,070 | (2) | | 33,522 | (5) | | (37,997) | |

Tax Rate | | -1.9% | | 31.4% | | | 45.7% | | | 16.6% | |

Net earnings attributable to Flowserve Corporation | $ | 125,949 | $ | (15,420) | | $ | (39,860) | | $ | 181,229 | (a) |

Operating cash flow | | | | | | | | | $ | 250,119 | |

Less: Capital expenditures | | | | | | | | | | (54,936) | |

Free cash flow | | | | | | | | | $ | 195,183 | (b) |

As adjusted free cash flow conversion rate (b)/(a) | | | | | | | | | | 108% | |

(1) Represents realignment expense incurred as a result of realignment programs. (2) Includes tax impact of items above and realignment related tax release. (3) Represents final settlement gain on sale of business in 2018. (4) Represents below-the-line foreign exchange impacts and $47.7 million of expense as a result of early extinguishment of debt and duplicate interest expense. (5) Includes tax impact of items above and $17.9 million benefit related to legal entity restructuring of foreign holding companies. |

2022 PROXY STATEMENT  83

83

Back to Contents

RECONCILIATION OF NON-GAAP MEASURES (Unaudited)

(Amounts in thousands,

except per share data) | Year Ended December 31, 2020 |

As Reported | Realignment(1) | Other Items | As Adjusted |

Sales | $ | 3,728,134 | $ | — | | $ | — | | $ | 3,728,134 | |

Gross profit | | 1,116,769 | | (47,297) | | | — | | | 1,164,066 | |

Gross margin | | 30.0% | | — | | | — | | | 31.2% | |

Selling, general and administrative expense | | (878,245) | | (34,773) | | | (34,269) | (3) | | (809,203) | |

Operating income | | 250,277 | | (82,070) | | | (34,269) | | | 366,616 | |

Operating income as a percentage of sales | | 6.7% | | — | | | — | | | 9.8% | |

Interest and other expense, net | | (47,985) | | — | | | 9,626 | (4) | | (57,611) | |

Earnings before income taxes | | 202,292 | | (82,070) | | | (24,643) | | | 309,005 | |

Provision for income taxes | | (61,417) | | 12,560 | (2) | | (2,814) | (5) | | (71,163) | |

Tax Rate | | 30.4% | | 15.3% | | | -11.4% | | | 23.0% | |

Net earnings attributable to Flowserve Corporation | $ | 130,420 | $ | (69,510) | | $ | (27,457) | | $ | 227,387 | (a) |

Operating cash flow | | | | | | | | | $ | 310,537 | |

Less: Capital expenditures | | | | | | | | | | (57,405) | |

Free cash flow | | | | | | | | | $ | 253,132 | (b) |

As adjusted free cash flow conversion rate (b)/(a) | | | | | | | | | | 111% | |

(1) Represents realignment expense incurred as a result of realignment programs. (2) Includes tax impact of items above. (3) Includes $22.7 million related to Flowserve 2.0 transformation efforts and $11.5 million related to discrete asset write-downs. (4) Represents below-the-line foreign exchange impacts. (5) Includes tax impact of items above, $25.4 million related to Italian tax valuation allowance and $15.6 million benefit related to legal entity simplification and restructuring. |

2022 PROXY STATEMENT  84

84

Back to Contents

Twelve Months Ended

December 31, 2022

(Amounts in thousands,

except per share data) | | Gross

Profit | | Selling,

General &

Administrative

Expenses | | Operating

Income | | Other

Income

(Expense),

Net | | Provision For

(Benefit From)

Income Taxes | | Net

Earnings

(Loss) | | Effective

Tax Rate | | Diluted

EPS |

| Reported | | $ | 994,295 | | 815,545 | | 197,219 | | (559) | | (43,639) | | 188,689 | | -28.3% | | $ | 1.44 |

| Reported as a percent of sales | | | 27.5% | | 22.6% | | 5.5% | | 0.0% | | -1.2% | | 5.2% | | | | | |

| Realignment charges(1) | | | 355 | | 520 | | (165) | | — | | 1,799 | | (1,964) | | -1090.3% | | | (0.01) |

| Discrete asset write-downs(2)(3)(4) | | | 13,490 | | (13,591) | | 27,081 | | — | | 1,967 | | 25,114 | | 7.3% | | | 0.19 |

| Below-the-line foreign exchange impacts(5) | | | — | | — | | — | | (9,694) | | (1,591) | | (8,103) | | 16.4% | | | (0.06) |

| Discrete tax benefit(6) | | | — | | — | | — | | - | | 59,313 | | (59,313) | | 0.0% | | | (0.45) |

| Adjusted | | $ | 1,008,140 | | 802,474 | | 224,135 | | (10,253) | | 17,849 | | 144,423 | | 10.4% | | $ | 1.10 |

| Adjusted as a percent of sales | | | 27.9% | | 22.2% | | 6.2% | | -0.3% | | 0.5% | | 4.0% | | | | | |

| Adjusted Net Earnings (Loss) | | $ | 144,423(a) | | | | | | | | | | | | | | | |

| Operating cash flow | | | (40,010) | | | | | | | | | | | | | | | |

| Less: Capital expenditures | | | (76,287) | | | | | | | | | | | | | | | |

| Free cash flow | | $ | (116,297)(b) | | | | | | | | | | | | | | | |

| As adjusted free cash flow conversion rate (b)/(a) | | | -81% | | | | | | | | | | | | | | | |

Back

Notes:

| Note: | Amounts may not recalculate due to rounding. |

| (1) | Charges represent realignment costs incurred as a result of realignment programs of which $170 is non-cash. |

| (2) | Includes reversals of expenses that were adjusted for Non-GAAP measures in previous periods of $9,843. |

| (3) | Charges represent a $33,888 reserve of Russia-related financial exposures. |

| (4) | Charge represents a $3,036 non-cash asset write-down associated with the impairment of a trademark. |

| (5) | Below-the-line foreign exchange impacts represent the remeasurement of foreign exchange derivative contracts as well as the remeasurement of assets and liabilities that are denominated in a currency other than a site’s respective functional currency. |

| (6) | Represents a discrete tax benefit due to release of tax valuation allowance on the net deferred tax assets in foreign jurisdictions. The associated tax expense was adjusted out in 2017. |

This Proxy Statement includes references to adjusted operating income, which is a “non-GAAP financial measure” as defined in the Securities Exchange Act of 1934, as amended. Adjusted operating income is calculated as operating income, plus certain realignment charges, discrete asset write-downs, and acquisition-related expenses. Management believes this measure presents to our investors an additional useful comparison between current results and results in prior operating periods and provides investors with a clearer view of the underlying trends of the business and that accordingly it should be utilized as a performance measure under the Company’s executive compensation plans. This non-GAAP financial measure, which may be inconsistent with similarly captioned measures presented by other companies, should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with GAAP.

| | |

| 2024 PROXY STATEMENT |  | 91 |

ANNEX II:

2023-2025 PEER PERFORMANCE GROUP

| | | | | | |

| 1 | Alaska Air Group, Inc. | 24 | Generac Holdings Inc. | 47 | Quanta Services, Inc. |

| 2 | Allegion plc | 25 | General Dynamics Corporation | 48 | RTX Corporation |

| 3 | American Airlines Group, Inc. | 26 | General Electric Company | 49 | Republic Services, Inc. |

| 4 | AMETEK, Inc. | 27 | Honeywell International Inc. | 50 | Robert Half Inc. |

| 5 | A.O. Smith Corporation | 28 | Howmet Aerospace Inc. | 51 | Rockwell Automation, Inc. |

| 6 | The Boeing Company | 29 | Huntington Ingalls Industries, Inc. | 52 | Rollins, Inc |

| 7 | Carrier Global Corporation | 30 | IDEX Corporation | 53 | Snap-on Incorporated |

| 8 | Caterpillar Inc. | 31 | Illinois Tool Works Inc. | 54 | Southwest Airlines Co. |

| 9 | C.H. Robinson Worldwide, Inc. | 32 | Ingersoll Rand Inc. | 55 | Stanley Black & Decker, Inc. |

| 10 | Cintas Corporation | 33 | Jacobs Solutions Inc. | 56 | Textron Inc. |

| 11 | Copart Inc | 34 | J.B. Hunt Transport Services, Inc. | 57 | Trane Technologies PLC |

| 12 | Costar Group, Inc. | 35 | Johnson Controls International plc | 58 | TransDigm Group Incorporated |

| 13 | CSX Corporation | 36 | L3Harris Technologies, Inc. | 59 | Union Pacific Corporation |

| 14 | Cummins Inc. | 37 | Leidos Holdings, Inc. | 60 | United Airlines Holdings, Inc. |

| 15 | Deere & Company | 38 | Lockheed Martin Corporation | 61 | United Parcel Service, Inc. |

| 16 | Delta Air Lines, Inc. | 39 | Masco Corporation | 62 | United Rentals, Inc. |

| 17 | Dover Corporation | 40 | Nordson Corporation | 63 | Verisk Analytics, Inc. |

| 18 | Eaton Corporation plc | 41 | Norfolk Southern Corporation | 64 | Waste Management, Inc. |

| 19 | Emerson Electric Co. | 42 | Northrop Grumman Corporation | 65 | Westinghouse Air Brake Technologies Corporation |

| 20 | Equifax Inc. | 43 | Old Dominion Freight Line, Inc. | 66 | W.W. Grainger, Inc. |

| 21 | Expeditors International of Washington, Inc. | 44 | Otis Worldwide Corporation | 67 | Xylem Inc. |

| 22 | Fastenal Company | 45 | PACCAR Inc | | |

| 23 | FedEx Corporation | 46 | Parker-Hannifin Corporation | | |

| | | | | | |

| | |

| 2024 PROXY STATEMENT |  | 92 |

ANNEX III:

2021-2023 PEER PERFORMANCE GROUP

Back(as comprised on 12/31/23 due to ContentsM&A activity that occurred over the 3-year performance period)

Dover Corporation

Ebara Corporation

Enovis Corporation

IDEX Corporation

IMI PLC

ITT Inc.

KSB Group

Rotork PLC

Xylem Inc.

Ingersoll Rand Inc.

Sulzer

| | |

| 2024 PROXY STATEMENT |  | 93 |

ANNEX IV:

EMPLOYEE STOCK PURCHASE PLAN

FLOWSERVE CORPORATION

2024 EMPLOYEE STOCK PURCHASE PLAN

SECTION 1. ESTABLISHMENT; PURPOSE.

Flowserve Corporation, a New York corporation (the “Company”), hereby establishes an employee stock purchase plan known as the Flowserve Corporation 2024 Employee Stock Purchase Plan (the “Plan”), effective as of February 9, 2024, subject to approval by the Company’s shareholders. The Plan shall continue to be effective until terminated pursuant to Section 20. The purpose of the Plan is to provide Participants with a convenient means to acquire an equity interest in the Company through payroll deductions, to enhance each Participant’s sense of participation in the affairs of the Company, and to provide an incentive for Participants to continue their affiliation with the Company. The Plan is not intended to qualify as an “employee stock purchase plan” under Section 423 of the Code (including any amendments, or replacements of such section).

SECTION 2. DEFINITIONS.

| (a) | “Accumulation Period” means the period during which contributions may be made toward the purchase of Stock under the Plan, as determined pursuant to Section 5. |

| (b) | “Committee” means the Organization and Compensation Committee of the Board, or any other committee appointed by the Board to administer the Plan, as described in Section 4. |

| (c) | “Compensation” is a Participant’s base wages or salary (i.e., exclusive of overtime or bonus payments) or the equivalent thereof, including, by way of example, vacation, jury duty or shift differential pay, paid to or on behalf of a Participant for services rendered to the Company or a Participating Employer. |

| (d) | “Board” means the Board of Directors of the Company. |

| (e) | “Code” means the Internal Revenue Code of 1986, as amended. |

| (f) | “Company” means Flowserve Corporation, a New York corporation. |

| (g) | “Election Form” has the meaning given in Section 5(b) below. |

| (h) | “Eligible Employee” means, for any Accumulation Period, any Employee of a Participating Employer, except those Employees: |

| (i) | who are included in a unit of Employees covered by a collective bargaining agreement, unless and to the extent such agreement provides that such Employees shall participate in the Plan, or the Participating Employer and the Committee have otherwise agreed to extend participation in the Plan to such Employees; |

| (ii) | who, as determined by the Committee in its sole discretion, are not regular or permanent full- or part-time Employees, including, without limitation interns or other temporary Employees; |

| (iii) | who are not treated as Employees by the Company or a Participating Employer for purposes of the Plan even though they may be so treated or considered under applicable law, including Code section 414(n), the Federal Insurance Contribution Act or the Fair Labor Standards Act (e.g., individuals treated as employees of a third party or as self-employed); or |